Loading

Get Ttb 5100.51 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TTB 5100.51 online

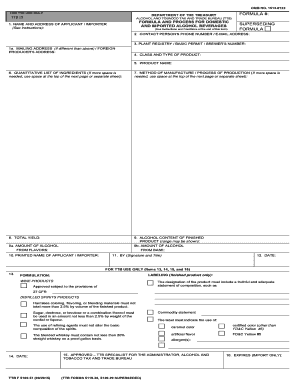

Filling out the TTB 5100.51 form is an essential step for applicants and importers of alcohol beverages. This guide provides clear, step-by-step instructions to help users navigate the online process efficiently.

Follow the steps to complete the TTB 5100.51 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the applicant or importer in Item 1. Ensure that both the name and address are complete and accurate.

- If the mailing address is different from the applicant's address, provide it in Item 1a. If applicable, include the foreign producer's address for imported products.

- In Item 2, list the contact person's phone number and email address for any necessary follow-up.

- For Item 3, input the plant registry, basic permit, or brewer’s number associated with the production facility.

- Identify the class and type of product in Item 4. Ensure this aligns with federal regulations without using brand names.

- Provide the product name in Item 5. If a specific name has not yet been decided, leave this field blank.

- In Item 6, submit a quantitative list of ingredients, specifying the kind and quantity used in the formulation.

- Detail the method of manufacture or production process in Item 7, using clear steps and timelines if needed.

- Record the total yield of the finished product in Item 8, providing exact measurements.

- In Item 9, indicate the alcohol content range for the finished product, followed by specifics in Items 9a and 9b for alcohol amounts derived from flavors or the malt base.

- Provide the printed name of the applicant or importer in Item 10, followed by the signature and title in Item 11.

- Lastly, enter the date of submission in Item 12.

- Upon completing the form, users can save changes, download, print, or share the document as needed.

Complete your TTB 5100.51 form online today for a seamless application process.

TTB approved means that your products, labels, or operations meet the standards set by the Alcohol and Tobacco Tax and Trade Bureau. Approval signifies that your business has complied with necessary regulations outlined in TTB 5100.51. This approval is crucial for legally marketing your products to consumers. Our services can help ensure that you achieve TTB approval seamlessly and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.