Get Tx Comptroller 05-166 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-166 online

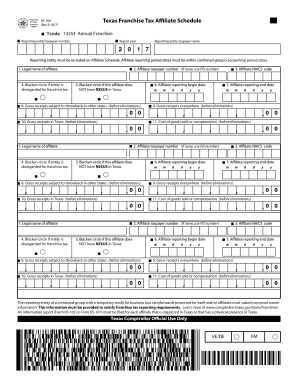

The TX Comptroller 05-166 form, known as the Texas Franchise Tax Affiliate Schedule, is essential for businesses reporting their franchise tax obligations. This guide will provide you with detailed instructions on filling out this form online, ensuring you meet all necessary requirements.

Follow the steps to complete your TX Comptroller 05-166 online

- Press the ‘Get Form’ button to access the TX Comptroller 05-166 form and open it for editing.

- Enter the reporting entity taxpayer number in the designated field. This number is essential for identifying your business.

- Fill in the report year by entering the four-digit year for which you are reporting.

- Provide the name of the reporting entity taxpayer as it appears on official documents.

- If applicable, indicate whether the entity is disregarded for franchise tax by marking the circle.

- Report the gross receipts subject to throwback in other states before any eliminations. Enter the amount in the specified field.

- Document the total gross receipts everywhere before any eliminations in the corresponding field.

- Record the gross receipts generated in Texas before eliminations in the appropriate section.

- Enter the cost of goods sold or compensation before eliminations in the designated field.

- If no amounts apply, use the Federal Employer Identification (FEI) number in the appropriate section.

- After completing all fields, review your entries for accuracy and completeness.

- You can then save your changes, download, print, or share the completed form as needed.

Complete your TX Comptroller 05-166 form online today to ensure compliance with Texas franchise tax regulations.

Get form

Filling out a sales tax exemption certificate in Texas requires specific information, such as your business name, address, and reason for exemption. You need to include your tax identification number and ensure that the certificate aligns with the requirements stated in TX Comptroller 05-166. If you find the process daunting, uslegalforms offers straightforward templates to streamline the completion of this certificate.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.