Loading

Get Tx Comptroller 05-166 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-166 online

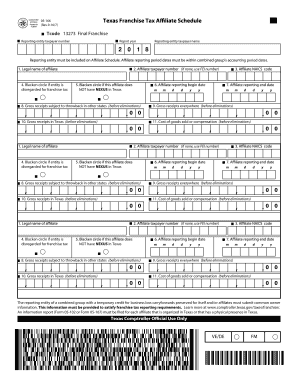

The TX Comptroller 05-166 form is essential for reporting franchise tax information in Texas. This guide will provide clear, step-by-step instructions to assist users in completing the form online efficiently.

Follow the steps to fill out the TX Comptroller 05-166 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the report year in the designated field. Ensure you input the correct year of the tax reporting period.

- Provide the reporting entity taxpayer number, which is crucial for identifying your business. If applicable, use your federal employer identification number (FEI).

- In section 4, blacken the circle if your entity is disregarded for franchise tax purposes.

- Fill out the gross receipts subject to throwback in other states in the appropriate field, ensuring accurate reporting before any eliminations.

- Enter the gross receipts everywhere before eliminations in the designated box. This should reflect total receipts across all states.

- Input the gross receipts specifically in Texas before eliminations. This is a critical aspect for state tax calculations.

- Report the cost of goods sold or compensation before eliminations as indicated in the relevant field. If none apply, use your FEI number.

- Once all fields are filled out correctly, review your entries for accuracy and completeness.

- Finalize your filing by saving the changes, downloading the form, printing it for your records, or sharing it as necessary.

Complete your TX Comptroller 05-166 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To find your franchise tax number in Texas, check the Texas Comptroller’s website, where you can search using your business's name or tax ID. This number is essential for filing taxes and complying with regulations outlined in the TX Comptroller 05-166. If you have trouble locating it, reaching out to resources like US Legal Forms can provide assistance in obtaining this critical identification.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.