Loading

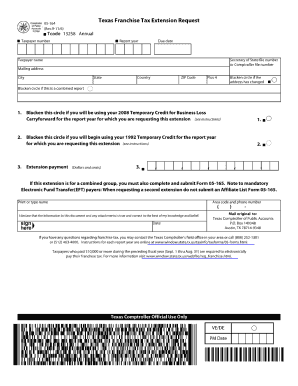

Get Tx Comptroller 05-164 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-164 online

This guide provides a clear and supportive overview of how to accurately complete the TX Comptroller 05-164 form online. Understanding each section will help ensure a smooth submission process and compliance with requirements.

Follow the steps to complete the form online effectively.

- Click ‘Get Form’ button to access the TX Comptroller 05-164 form and open it in the editor.

- Begin by entering your identifying information in the designated fields. This includes your name, address, and contact information. Ensure each entry is accurate to prevent any processing delays.

- Proceed to the section that requests details about your business or organization. Fill in the required information, such as the name of the entity, type of ownership, and any relevant identification numbers.

- Next, carefully complete the financial sections by providing necessary financial data as prompted. Pay close attention to the requested figures and confirm their accuracy before moving on.

- Review all information entered in the form to ensure that it is complete and correct. This step is critical to avoid errors that could lead to complications later.

- Once you have verified all information, you can save your progress, download a copy of the form, print it for records, or share it as needed.

Complete the TX Comptroller 05-164 online today and streamline your document submission process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To request a penalty waiver for late filing of franchise taxes, you must submit your request through the Texas Comptroller's website. Provide a valid reason and any supporting documents that explain the delay. Getting this waiver can help reduce financial strain and help you stay compliant with the TX Comptroller 05-164 regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.