Loading

Get Treasurydirect Fs 4000 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TreasuryDirect FS 4000 online

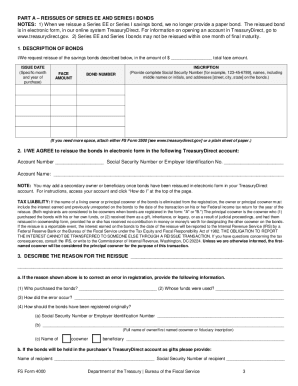

Filling out the TreasuryDirect FS 4000 form is an essential process for users wishing to reissue United States savings bonds. This guide provides clear, step-by-step instructions to assist you in successfully completing the form online.

Follow the steps to complete the TreasuryDirect FS 4000 form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the digital editor.

- Begin filling out Part A by providing the description of the bonds you are requesting to reissue. Include the total face amount, issue date, bond number, and the complete inscription, which includes the Social Security Number and names of all owners.

- In the same section, agree to reissue the bonds in electronic form by entering your TreasuryDirect account number and account name, along with the required taxpayer identification number.

- State the reason for the reissue in the designated area. If correcting an error, provide detailed information regarding who purchased the bonds, whose funds were used, and how the error occurred.

- Navigate to Part B to describe any Series HH bonds if applicable. Fill in the same type of information as required in Part A, including bond details and registration information.

- Proceed to Part C, where all involved parties must certify the information provided. Each person named on the bonds must sign the form in ink and in the presence of a certifying officer.

- After completing all sections, ensure all required documentation is attached, if necessary, and review your information for accuracy before submitting.

- Finally, you can save changes, download, print, or share the completed form as needed.

Complete your TreasuryDirect FS 4000 form online today to ensure the smooth reissuance of your savings bonds.

Related links form

You should report savings bonds in the interest income section of your tax return, specifically on Line 2b of Form 1040. It's essential to include any interest reported on Form 1099-INT if applicable. The TreasuryDirect FS 4000 keeps your investments organized, making it easier to gather this information at tax time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.