Loading

Get Tx 25-104 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 25-104 online

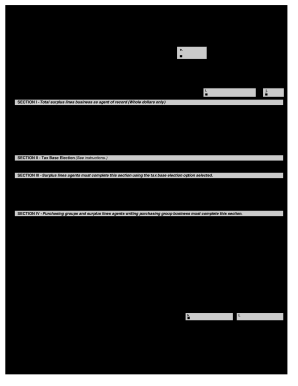

The TX 25-104 is the Texas Annual Insurance Tax Report required for surplus lines agents and purchasing groups. This guide provides clear, step-by-step instructions to help users accurately complete this form online.

Follow the steps to fill out the TX 25-104 correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter your taxpayer number, name, and tax report mailing address. If your mailing address has changed, blacken the provided box and make the necessary changes beside the preprinted information.

- Proceed to Section I where you need to report total surplus lines business. Enter the total Texas premiums reported to the Surplus Lines Stamping Office of Texas (SLSOT) in Item A, and follow with Items B through F accordingly, ensuring you do not include non-taxable premiums where applicable.

- In Section II, select your tax base election. Surplus lines agents should indicate whether they are using a premium-written or premium-received basis.

- Move to Section III, where surplus lines agents report premiums based on their selected tax base. Fill out the Texas premiums, Texas returned premiums, taxable premiums, and premium tax due accurately.

- For purchasing groups, go to Section IV. Input the necessary Texas premiums, returned premiums, and calculate the taxable premiums and tax due in the corresponding fields.

- Complete any additional fields as required, including the total amount due and penalty or interest if applicable.

- Finally, review all information for accuracy, save your changes, and then either download the form for your records, print it, or share it as necessary.

Complete and submit your TX 25-104 online to ensure compliance with Texas state tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out a withholding allowance form, begin by reviewing your personal tax situation, including number of allowances you may claim. Make sure to follow the instructions closely to ensure you provide accurate information aligned with TX 25-104 standards. Taking this step can help you manage your paycheck effectively. Platforms like US Legal Forms can provide templates and support for completing this form correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.