Loading

Get Tx 5200 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 5200 online

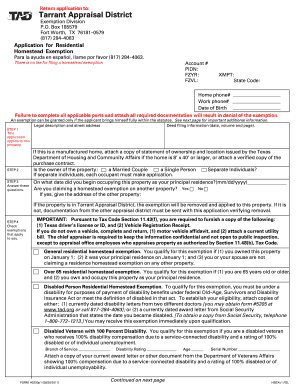

Filling out the TX 5200 form for a residential homestead exemption can be straightforward when you have the right guidance. This guide offers clear steps that you can follow to ensure your application is completed correctly.

Follow the steps to successfully complete the TX 5200 application online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your account number and property identification number (PIDN) as indicated. Make sure these details match the records from the Tarrant Appraisal District.

- Provide your home phone number, work phone number, and date of birth. This information helps establish your identity and connection to the property.

- Fill in the legal description and street address of the property for which you are claiming the exemption. It is crucial this information is accurate to avoid any delays.

- Indicate whether the application applies to this property by confirming your occupancy status and the date you began residing there. Use the required mm/dd/yyyy format for clarity.

- Answer the questions regarding your marital status and whether you are claiming a homestead exemption on another property. If applicable, provide the address of the other property.

- Check all exemptions that apply to you, such as age, disability, or survivor status. Attach any required documentation, such as a driver's license or vehicle registration, as specified in the instructions.

- Finally, sign and date the application, confirming that all the information provided is true and correct. This step is essential for the processing of your exemption.

- After completing the form, you can save your changes, download a copy for your records, print the application, or share it as needed for submission.

Complete your TX 5200 application online today to ensure you receive your residential homestead exemption.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Qualifying Widow (or Qualifying Widower) is a filing status that allows you to retain the benefits of the Married Filing Jointly status for two years after the year of your spouse's death. You must have a dependent child in order to file as a Qualifying Widow or Widower.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.