Loading

Get Tx 5200 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 5200 online

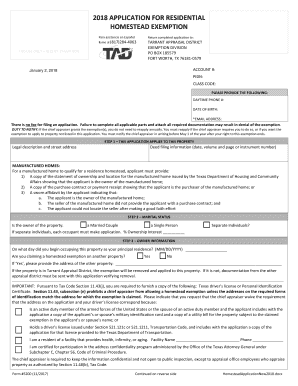

The TX 5200 is an important form for individuals seeking a residential homestead exemption in Texas. This guide provides a clear, step-by-step process to help users navigate the online filling of the TX 5200 effectively.

Follow the steps to complete the TX 5200 online.

- Click ‘Get Form’ button to obtain the TX 5200 and open it in the designated editor.

- Fill in the owner names in the designated fields. Ensure that both Owner Name 1 and Owner Name 2 (if applicable) are entered correctly as this is crucial for identification.

- Enter the street address of the property where you are claiming the exemption. Include the city, state, and zip code in their respective fields.

- Provide a daytime phone number where you can be reached for any follow-up questions regarding your application.

- Input the date of birth of the primary owner. This is necessary to help verify eligibility for certain exemptions.

- Select the marital status of the property owner(s), indicating whether they are a married couple or a single person. If separate individuals, each occupant must apply individually. Specify the ownership interest percentage.

- Answer the question regarding the date you began occupying the property as your primary residence, using the format MM/DD/YYYY.

- Respond to the query about any other homestead exemptions currently claimed on different properties. If applicable, provide the address of that property.

- Check the relevant exemptions that apply to you, including General Residence Homestead, Age 65 or Older, Disabled Person, and others as specified.

- If claiming a disability exemption, ensure to attach the required documentation to support your claim. This may include letters from doctors or Social Security Administration documents.

- Review all entered information to ensure accuracy, as any false statements can lead to penalties.

- Finally, save your changes, download, print, or share the completed form as needed, ensuring you keep a copy for your records.

Complete your TX 5200 form online today to ensure timely processing of your homestead exemption application.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Schedule 4 is where you'll report other taxes you might owe in addition to your standard income tax.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.