Loading

Get Treasury Fs 1048 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Treasury FS 1048 online

Filling out the Treasury FS 1048 form online is an essential step for individuals seeking to claim lost, stolen, or destroyed United States Savings Bonds. This guide provides clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the Treasury FS 1048 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

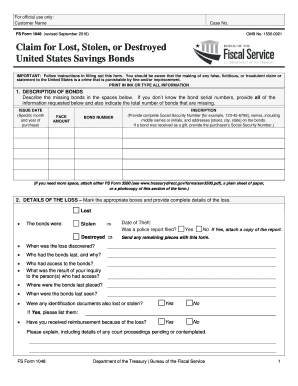

- In the 'Description of Bonds' section, provide details about the missing bonds, including the issue date, face amount, bond number, and complete inscription including names and addresses. If bond serial numbers are not known, include the total number of missing bonds and all other requested information.

- In the 'Details of the Loss' section, mark the appropriate boxes to indicate whether the bonds were lost, stolen, or destroyed. Provide specific details about the loss, including the date of theft (if applicable), police report status, and any other relevant information.

- Complete the 'Authority' section by specifying if you are named on the bonds or providing your legal authority to make a claim. If you are not the named individual, detail your relationship or authority supporting your claim.

- If any minors are named on the bonds, fill out the relevant details in the 'Minors' section, including the minor's date of birth, relationship to the minor, and support information.

- Indicate your preference for how to receive relief in the 'Relief Requested' section. Note if you prefer substitute bonds or payment by direct deposit and specify the type of bonds involved.

- Provide delivery instructions in the next section based on the type of relief being requested. Ensure to include necessary account information if applicable.

- In the 'Signatures and Certification' section, ensure all required individuals sign the form in ink, print their names, and provide their contact information. Remember that signatures must be certified by an authorized officer.

- After completing all sections accurately, review the form, make any necessary changes, save your changes, and proceed to download, print, or share the completed form as needed.

Complete your Treasury FS 1048 form online today to ensure your claim is processed efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you must report interest earned from Treasury bonds. The Internal Revenue Service (IRS) considers this interest as taxable income. When you receive the Treasury FS 1048, it will help you accurately report this income on your tax return. It's important to keep track of all your investments to ensure compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.