Get Sc St-8f 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC ST-8F online

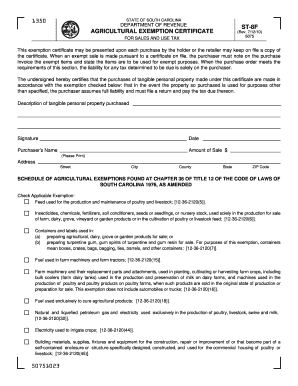

The SC ST-8F form is an agricultural exemption certificate used in South Carolina for sales and use tax purposes. Completing this form accurately is essential for individuals or organizations looking to claim tax exemptions on eligible agricultural purchases.

Follow the steps to fill out the SC ST-8F online:

- Use the ‘Get Form’ button to access the SC ST-8F form and open it in your preferred editor.

- Begin by providing the purchaser's name. Make sure to print the name clearly.

- Enter the address accurately, including street, city, county, state, and ZIP code.

- Specify the amount of sale in the designated field. Ensure that this is correct as it may affect the exemption.

- In the 'description of tangible personal property purchased' section, describe the items you are claiming exemption for.

- Select the appropriate exemption by checking the applicable box. Refer to the exemptions outlined in the form to determine which applies to your purchase.

- Sign and date the form at the bottom to validate your claim.

- Once you have completed all sections of the form, save your changes. You may then choose to download, print, or share the completed form as needed.

Start filling out your SC ST-8F form online today to take advantage of your agricultural tax exemptions.

Eligibility for a Scate card typically includes farmers who meet specific agricultural production criteria and have documented proof of farming activities. This card can help facilitate access to various agricultural programs and resources. Investigating the SC ST-8F form and its implications can support your application process. It’s advisable to check with state authorities for detailed requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.