Loading

Get Sc St-8 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC ST-8 online

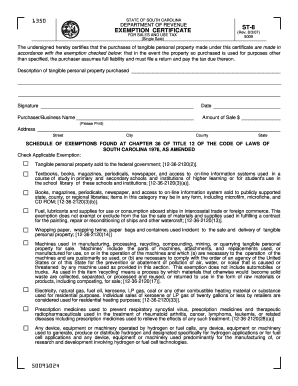

The SC ST-8 exemption certificate allows individuals and businesses in South Carolina to certify their eligibility for sales and use tax exemptions when purchasing tangible personal property. This guide will provide clear and step-by-step instructions for successfully completing the SC ST-8 online.

Follow the steps to complete the SC ST-8 exemption certificate online.

- Press the ‘Get Form’ button to access the SC ST-8 exemption certificate and open it in your preferred online editor.

- Carefully read the instructions provided on the form to understand the purpose and requirements for filling it out.

- In the designated section, fill in the description of the tangible personal property you are purchasing.

- Provide your signature in the appropriate field, confirming that the information provided is accurate.

- Enter the date of completion in the space designated for the date.

- Fill in your name or the name of your business as the purchaser, ensuring it is printed clearly.

- State the total amount of the sale to reflect the transaction accurately.

- Complete your address, including street, city, county, and state to provide your contact details.

- Select the applicable exemption by checking the correct box that corresponds to your purchase type.

- Review all entries for accuracy, save the completed document, and proceed to download, print, or share as needed.

Complete your SC ST-8 exemption certificate online today to ensure a smooth exemption process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Whether you need to file a SC tax return depends on your income level and other factors. Generally, if you earn above a particular threshold, you are required to file. However, even if you are not required, filing can offer potential credits and deductions, such as those available through the SC ST-8 program.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.