Loading

Get Sc Dor C-268 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR C-268 online

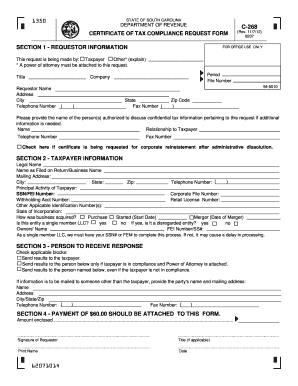

The SC DoR C-268 is a vital form used to request a Certificate of Tax Compliance in South Carolina. This guide will provide clear instructions on how to complete the form online, ensuring that users can navigate each section with confidence.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1 - Requestor Information, enter your name, current mailing address, daytime telephone number, and fax number.

- Provide the title and the period for which the Certificate of Tax Compliance is being requested. Include your company name and file number if applicable.

- List the name of the authorized person(s) who can discuss confidential tax information if more information is needed. Include their relationship to the taxpayer, telephone number, and fax number.

- In Section 2 - Taxpayer Information, fill out the legal name of the taxpayer, name as filed on the return, and mailing address, as well as the taxpayer's SSN/FEI number and other identification numbers.

- Indicate the principal activity of the taxpayer and provide the state of incorporation, if applicable.

- Answer the questions regarding business acquisition and whether the entity is a single member LLC. If applicable, provide the owner's name.

- In Section 3 - Person to Receive Response, check the appropriate boxes to designate where the results should be sent, whether to the taxpayer or another authorized person.

- In Section 4, ensure that an administrative fee of $60.00 is attached to the form. Make sure to sign and print your name, along with the date, and indicate your title if applicable.

- Finally, review the completed form for accuracy and ensure all required fields are filled. Save your changes, then download, print, or share the form as needed.

Complete your SC DoR C-268 online to ensure a smooth application process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, in South Carolina, corporations and certain business entities are required to file an annual report with the SC Department of Revenue, known as SC DoR C-268. This report updates the state about your business operations and standing. Failure to file may incur penalties. For assistance in preparing your annual report, uslegalforms offers handy tools and resources to help you stay compliant.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.