Loading

Get Voluntary Payroll Deduction Authorization Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Voluntary Payroll Deduction Authorization Form online

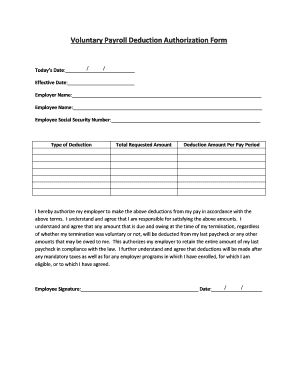

Filling out the Voluntary Payroll Deduction Authorization Form online is a straightforward process that allows users to authorize deductions from their payroll for various purposes. This guide provides detailed, step-by-step instructions to ensure a smooth completion of the form.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter today’s date in the designated field. This allows for a clear record of when the authorization is being made.

- Fill in the effective date. This is the date from which the payroll deductions will commence.

- Input the employer's name in the appropriate section to identify the organization processing the deductions.

- Provide your full name as the employee in the space provided.

- Enter your Social Security number in the specified field, ensuring the information is accurate and up-to-date.

- Select the type of deduction you are authorizing. This may vary depending on what deductions are available.

- Indicate the total requested amount for the deduction to be taken from your pay.

- Specify the deduction amount per pay period, helping to establish how much will be deducted from each paycheck.

- Read the authorization statement carefully. By signing, you agree to the terms outlined and authorize your employer to make the specified deductions.

- Sign the form in the designated area and provide the date of your signature, confirming your consent.

- Once all fields are completed, you can save your changes, download a copy, print the form, or share it as needed.

Start completing your Voluntary Payroll Deduction Authorization Form online today!

Voluntary deductions are amounts which an employee has elected to have subtracted from gross pay. Examples are group life insurance, healthcare and/or other benefit deductions, Credit Union deductions, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.