Loading

Get Uk Hmrc Starter Checklist 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC Starter Checklist online

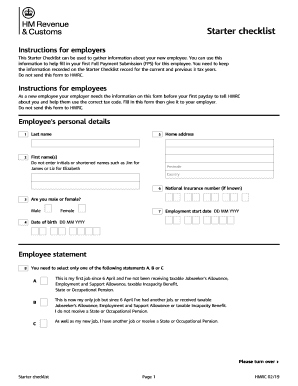

The UK HMRC Starter Checklist is an essential document for new employees, providing necessary information to ensure accurate tax code assignment. This guide will assist you in completing the form online efficiently and accurately.

Follow the steps to complete the UK HMRC Starter Checklist online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your last name in the designated field. Ensure to use your complete last name without any abbreviations.

- Input your first name(s) and avoid using initials or shortened names such as Jim for James.

- Provide your home address along with the postcode and country.

- If known, enter your National Insurance number in the appropriate field.

- Specify your employment start date in the format DD MM YYYY.

- Indicate your gender by selecting either male or female.

- Fill in your date of birth using the format DD MM YYYY.

- Choose the appropriate statement from the options A, B, or C that describes your employment situation. Only select one.

- If applicable, indicate whether you have a Student Loan that is not fully repaid by answering Yes or No.

- If you answered Yes to having a Student Loan, specify if you completed or left your studies before 6th April.

- Indicate the type of Student Loan you have by selecting either Plan 1 or Plan 2.

- Answer if you are repaying your Student Loan directly to the Student Loans Company by direct debit.

- If applicable, indicate whether you have a Postgraduate Loan that is not fully repaid.

- Complete the Declaration section by confirming the information provided is accurate. Sign your full name and enter the date in DD MM YYYY format.

- After filling out the form, save your changes, and you can choose to download, print, or share the form as needed.

Complete the UK HMRC Starter Checklist online to ensure a smooth employment start.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The 'C' option on the HMRC starter checklist indicates that your new employee has not provided a P45 from their previous job, hence they may be assigned a different tax code. This selection impacts how their tax is calculated at the start of their employment. It's crucial to understand these tax code implications as you complete the UK HMRC Starter Checklist.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.