Loading

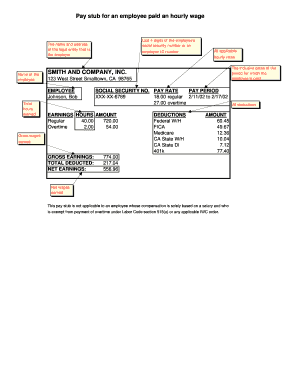

Get Pay Stub For An Employee Paid An Hourly Wage

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pay Stub for an Employee Paid an Hourly Wage online

Understanding how to complete a pay stub for an hourly employee is essential for accurate payroll processing. This guide offers detailed, step-by-step instructions to help you fill out the pay stub form online effectively.

Follow the steps to complete the pay stub form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the last four digits of the employee's social security number in the designated field. This information is crucial for identification and record-keeping.

- Fill in the name and address of the legal entity that is the employer. Be sure to provide complete and accurate details, such as 'Smith and Company, Inc., 123 West Street, Smalltown, CA 98765.'

- Enter the name of the employee as it appears in official records, for instance, 'Johnson, Bob.' This information will prevent any discrepancies during payroll.

- Specify all applicable hourly rates in the section provided. Include both regular and overtime rates where necessary, for example, 'Regular: $18.00, Overtime: $27.00.'

- Indicate the inclusive dates of the pay period, such as '2/11/02 to 2/17/02.' Accurate dates are vital to ensure timely payments.

- Input the total hours worked during the pay period in the corresponding fields, for example, 'Regular: 40.00, Overtime: 2.00.' This should reflect the actual hours the employee worked.

- Calculate and enter the earnings based on the hours worked by multiplying the hours by their respective rates. For instance, 'Regular: $720.00, Overtime: $54.00.'

- Complete the deductions section by listing all applicable deductions such as federal withholding, FICA, Medicare, and any state deductions along with their respective amounts.

- Sum the gross earnings and net earnings. Calculate the total deducted from gross wages to find the net wages earned. Ensure these calculations are coherent and accurate.

- Once all sections are filled accurately, you can save changes, download, print, or share the completed pay stub as necessary.

Start filling out your pay stub online today for a seamless payroll experience.

Related links form

To prove that you have no income, you can provide a declaration of no income, which states your current financial situation. Supporting documents, such as bank statements showing zero deposits or tax returns indicating no earned income, can strengthen your claim. If necessary, consider utilizing the US Legal Forms platform, which offers templates for such declarations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.