Loading

Get Paychex Rs0079 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Paychex RS0079 online

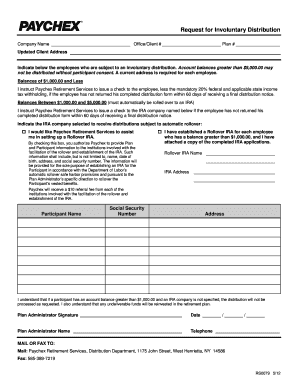

The Paychex RS0079 form is used to request involuntary distributions from retirement accounts. This guide provides clear steps to fill out the form accurately, ensuring compliance with distribution regulations.

Follow the steps to successfully complete the Paychex RS0079 form.

- Click the ‘Get Form’ button to obtain the Paychex RS0079 form and open it for editing.

- Enter the company name, office/client number, and plan number at the top of the form.

- Update the client address in the designated section to ensure accurate communication.

- List the employees who are subject to involuntary distribution. Ensure that account balances are noted; only those over $5,000 can be processed with participant consent.

- For balances of $1,000 or less, indicate your instruction for Paychex Retirement Services to issue a check to the employee, deducting mandatory tax withholdings.

- For balances between $1,000 and $5,000, provide the name of the IRA company that should receive distributions subject to automatic rollover.

- If you wish for Paychex to assist in setting up a Rollover IRA, check the box and ensure to provide the necessary authorizations.

- If a Rollover IRA has already been established for each employee, check the appropriate box and attach copies of the completed IRA applications.

- Fill in the name of the Rollover IRA and its address if applicable.

- Provide participant names, social security numbers, and addresses for the employees involved in the distribution.

- Complete the Plan Administrator section by signing, dating, and providing your name and telephone number.

- Finally, save your changes, and choose to download, print, or share the completed form as required.

Complete your Paychex RS0079 form online today for efficient processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To enroll in Paychex RS0079 direct deposit, first, access the enrollment form from your Paychex account. Fill in your contact information, account details, and indicate the deposit preferences. Once completed, submit the form through the designated process outlined in your Paychex account, and check for confirmation of enrollment.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.