Loading

Get Ar1023ct Phone Line Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar1023ct Phone Line Form online

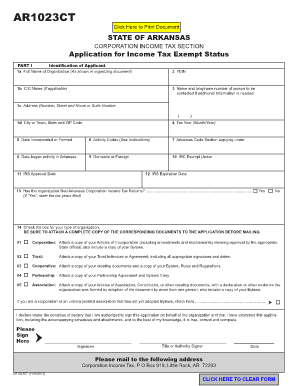

Filling out the Ar1023ct Phone Line Form online is a crucial step for organizations seeking income tax exemption in Arkansas. This guide provides clear, step-by-step instructions to help users navigate each section of the form effortlessly.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing the full name of the organization in the designated field. Ensure that it matches the name listed in your organizing document to avoid any discrepancies.

- In the next field, enter the Federal Employer Identification Number (FEIN) assigned to your organization. This is essential for tax identification purposes.

- If applicable, include the name of an individual or department that is the point of contact for additional information in the C/O Name field.

- Fill in the complete address of the organization, including the street address, city or town, state, and ZIP code.

- Specify the tax year in the format of month and year, which represents the period for which you are seeking tax-exempt status.

- Indicate the date the organization was incorporated or formed. This date is crucial for determining eligibility.

- List the relevant activity codes that correspond to your organization’s activities as per the instructions provided.

- Identify the Arkansas Code Section under which you are applying for exemption.

- Note the date when your organization began its activities in Arkansas.

- Specify whether your organization is domestic or foreign.

- Indicate the specific Internal Revenue Code (IRC) section under which your organization is claiming exemption.

- Provide the date on which you received IRS approval for your tax-exempt status.

- If applicable, state the IRS expiration date of your exemption.

- Answer whether the organization has filed Arkansas Corporation Income Tax Returns in the past and specify the tax years if ‘Yes’ is selected.

- Select the type of organization and attach the necessary documents as indicated, such as articles of incorporation, bylaws, or partnership agreements.

- Sign the form to declare under penalties of perjury that the information provided is true, correct, and complete.

- After completing all fields and verifying the information, save your changes. You may download, print, or share the completed form as needed.

Start filling out your documents online today!

Right-click the comment, and choose Delete Comment. To delete all the comments in the document, go to the Review tab, click the down-arrow on Delete, and choose Delete All Comments in Document.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.