Loading

Get Ptax 300 R 303 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ptax 300 R 303 Form online

Filling out the Ptax 300 R 303 Form electronically can streamline your property tax exemption application process. This guide provides detailed, user-friendly instructions to ensure you complete each section accurately and efficiently.

Follow the steps to complete the Ptax 300 R 303 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

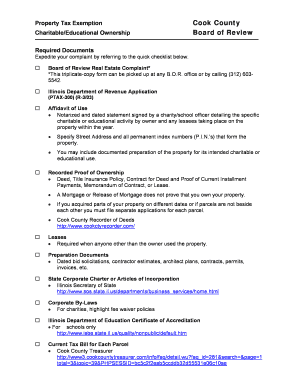

- Begin with the main section where you will specify the property address. Ensure you include all permanent index numbers (P.I.N.s) associated with the property.

- Next, provide a notarized statement, known as the affidavit of use, which details specific charitable or educational activities performed on the property during the year.

- Include recorded proof of ownership. You may submit documents such as a deed or title insurance policy proving your ownership. Remember that a mortgage does not confirm property ownership.

- If applicable, upload lease agreements when others, aside from the owner, have used the property.

- Attach preparation documents that demonstrate the intended use of the property, such as contractor estimates or architectural plans.

- Provide the necessary corporate documents, such as the state corporate charter, articles of incorporation, and corporate by-laws, specifically highlighting any fee waiver policies for charities.

- Add current tax bills for each parcel of property. This information can be obtained from the Cook County Treasurer's office.

- When completed, review the form thoroughly for any errors or missing information. After ensuring accuracy, you can save the changes, then download, print, or share the form as needed.

Start filling out your Ptax 300 R 303 Form online today to ensure your property tax exemption.

Do I have to apply every year? No. Once you apply, the Homeowner Exemption will renew automatically in subsequent years as long as your residency remains the same.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.