Loading

Get Irs 1120 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120 online

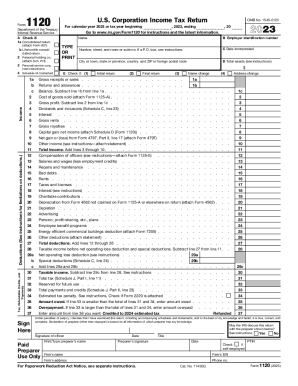

Filing the IRS Form 1120 is an essential step for corporations to report their income, gains, losses, deductions, and credits. This guide provides clear instructions on how to effectively fill out this form online, ensuring compliance with tax obligations.

Follow the steps to complete your IRS Form 1120 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the basic information about your corporation. Fill in the corporation's name, employer identification number (EIN), and address. Make sure to indicate the date of incorporation as well.

- Specify if the return is consolidated by checking the appropriate box and attach Form 851 if applicable. Indicate if you are filing a personal holding company return or if there are any changes in the corporation, such as name or address changes.

- Enter total assets in the designated field. This will be based on your balance sheet at the end of the tax year, ensuring that all relevant asset information is accurately reported.

- Proceed to the income section. Report all income, including gross receipts, dividends, and any other income sources. Use the instructions to ensure all lines are appropriately filled out.

- Document all deductions in the appropriate section. This includes items such as salaries, wages, and various expenses. It is crucial to refer to the relevant IRS instructions for limitations on deductions.

- Calculate taxable income by subtracting total deductions from total income. Ensure that any net operating loss deductions are correctly included.

- In the tax section, calculate your total tax amount using the appropriate schedules. Ensure to include credits and payments for accurate tax submission.

- Sign and date the form confirming the truthfulness of the information provided in compliance with IRS requirements. Ensure the declaration includes your printed name and title.

- Review the completed form for accuracy. Afterwards, you can save the changes, download, print, or share the form as needed.

Complete your IRS Form 1120 online today to stay compliant with tax regulations.

Because the taxable income on an 1120-H tax return is high – 30% for HOAs using form 1120-H. When filing form 1120-H, the association is not subject to tax on any net exempt function income. However, it is subject to tax on any net income from non-exempt activities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.