Loading

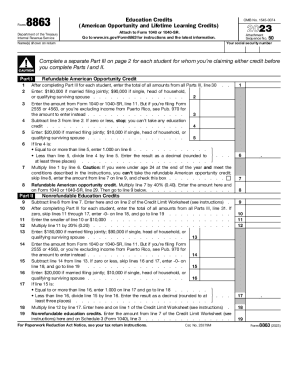

Get Irs 8863 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8863 online

The IRS Form 8863 is essential for those seeking education credits, specifically the American Opportunity Credit and Lifetime Learning Credit. This guide will walk you through the process of completing this form online, ensuring you provide all necessary information accurately.

Follow the steps to complete the IRS Form 8863 online.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Begin by entering your social security number and the name(s) shown on your tax return at the top of the form.

- For Part I, complete a separate Part III for each student for whom you're claiming an education credit before proceeding with Parts I and II.

- In Part I, calculate the refundable American Opportunity Credit. Enter the total amounts from all Parts III on line 1 and follow through the calculations as directed.

- Continue through the established lines, entering your income from Form 1040 or 1040-SR where required, and follow the instructions for the calculations for each field.

- For Part II, focus on the nonrefundable education credits, following the instructions for lines 10 through 17 as you calculate amounts based on provided guidance.

- Complete Part III for each student, entering their name and educational institution information, ensuring you follow each question accurately.

- Once all parts of the form are completed, review your entries for accuracy, make any necessary changes, and finalize your form.

- Save changes to your form, and select an option to download, print, or share your completed IRS Form 8863 as required.

Complete your IRS Form 8863 online today to ensure you maximize your education credits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

By law, tax-free benefits under an educational assistance program are limited to $5,250 per employee per year. Normally, assistance provided above that level is taxable as wages.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.