Loading

Get Vt In 113 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vt In 113 Form online

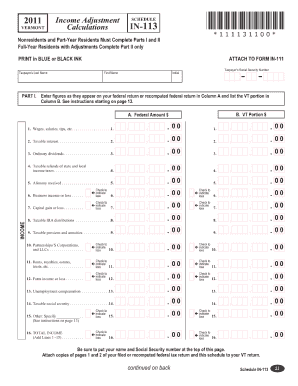

The Vt In 113 Form is an essential document for various administrative processes. This guide provides clear and structured steps to assist users in completing the form effectively online.

Follow the steps to successfully fill out the Vt In 113 Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the personal information section, including your full name, address, and contact details. Ensure that all information is accurate and complete.

- Next, proceed to the identification section, where you will enter any required identification numbers or codes. Double-check for correctness to avoid any issues during submission.

- In the main content area of the form, you will find specific fields asking for details relevant to your case or inquiry. Provide thorough and precise information as required.

- Review all sections carefully once you have entered all information. Make any necessary edits to ensure clarity and accuracy.

- Finally, use the options available to save your changes, download a copy of the completed form, print it out if needed, or share it directly from the platform.

Start filling out your Vt In 113 Form online today to streamline your process!

What's the threshold for economic nexus law in Vermont? Threshold: Sales of $100,000 or more in the state, or at least 200 individual sales transactions into the state during any preceding twelve-month period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.