Loading

Get Form 8843 - Statement For Exempt Individuals And ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8843 - Statement For Exempt Individuals And ... online

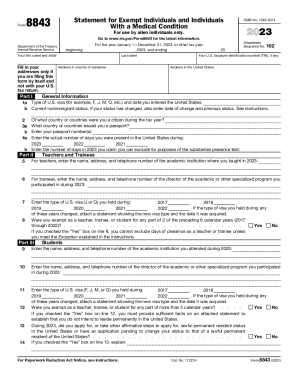

Filling out Form 8843 is essential for non-U.S. residents seeking to claim exemption from the substantial presence test due to their unique circumstances. This guide provides clear and supportive instructions to help users complete this form online with ease.

Follow the steps to fill out Form 8843 online

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Complete Part I with your general information. Enter your first name and initial, last name, address in your country of residence, and your taxpayer identification number if applicable.

- For Line 1a, indicate the type of U.S. visa you possess and the date of your entry into the United States. For Line 1b, specify your current nonimmigrant status.

- In Lines 2 and 3a, provide the country or countries of citizenship and passport details, as well as the number of days you were present in the U.S. during the past three years.

- Move to Part II if you are a teacher or trainee. Enter the name, address, and telephone number of the academic institution where you taught or the program director details.

- Part III is for students. Fill in the name, address, and contact information of your academic institution and the program director.

- If applicable, complete Part IV for professional athletes, including details of the charitable sports events you participated in during 2023.

- In Part V, provide information regarding any medical condition that prevented your departure from the U.S., including relevant dates and a physician’s statement.

- After completing all relevant sections, review your form for accuracy. Save your changes, and then download or print your completed Form 8843. If filing separately, send it to the IRS by the designated due date.

Start completing your Form 8843 online today to ensure timely submission!

Form 8843 Statement for Exempt Individuals and Individuals with a Medical Condition, is used to exclude days of presence in the U.S. for certain individuals. The form needs to be filed with your Form 1040-NR U.S. Nonresident Alien Income Tax Return., and if you don't need to file a return, send the form to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.