Loading

Get Ct 1040 Crc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 1040 Crc online

This guide provides detailed instructions on how to complete the Ct 1040 Crc form online. Whether you are new to filling out tax forms or looking for a refresher, these step-by-step directions will help simplify the process.

Follow the steps to complete the Ct 1040 Crc form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Start by entering your first name and middle initial in the designated field, followed by your last name. If you are submitting a joint return, enter your partner’s first name and middle initial as well.

- Next, input the Social Security Number for both yourself and your partner, if applicable. Make sure to enter the numbers accurately to avoid delays.

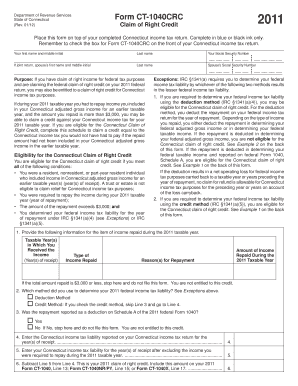

- Provide details regarding your claim of right income. This includes the taxable year(s) you received the income, the type of income repaid, the amount of income repaid during the 2011 taxable year, and the reasons for repayment.

- Indicate which method you used to determine your federal income tax liability by checking the relevant box for either the deduction method or the credit method.

- If you selected the credit method, skip Line 3. If you opted for the deduction method, check whether the repayment was reported as a deduction on Schedule A of your federal Form 1040.

- Then, enter your Connecticut income tax liability reported for the year(s) of receipt. Ensure you provide the amount accurately as originally filed or adjusted.

- Next, calculate your Connecticut income tax liability after excluding the repaid income, and input this value.

- Finally, subtract the amount from Line 5 from Line 4 to determine your 2011 claim of right credit. Include this amount on the appropriate lines of your tax return.

- Review all entries for accuracy. Once completed, save your changes. You can download, print, or share the form as required.

Complete your documents online today for a smooth filing experience.

* The only differences on page 1 of the two forms is that Form 1040-SR has bigger print, bigger spaces for the information and numbers that senior taxpayers must enter, and a more easily-decoded standard deduction table with bigger print. ... Otherwise, it's identical to page 2 of the regular Form 1040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.