Loading

Get Irs 433-a (oic) (sp)_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 433-A (OIC) (SP)_DSA online

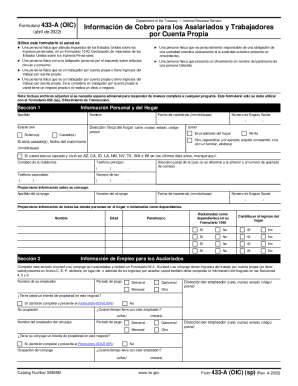

Filling out the IRS 433-A (OIC) (SP)_DSA form is a vital step in applying for an offer in compromise with the Internal Revenue Service. This guide provides a comprehensive approach to completing the form online, ensuring clarity and accuracy as you submit your financial information.

Follow the steps to complete your IRS 433-A (OIC) (SP)_DSA form online successfully.

- Click ‘Get Form’ button to access the form and open it in your online document editor.

- Begin filling out Section 1, which captures your personal and household information. Provide your last name, first name, social security number, birth date, marital status, and home address. If applicable, include your spouse's information.

- Complete Section 2 for employment information. If you or your spouse are employed, provide details about your employer, including the name, pay frequency, and contact information.

- In Section 3, provide a comprehensive list of your personal assets, including cash, bank accounts, investments, and real estate. Be sure to include the value and any debts associated with these assets.

- If you are self-employed, move to Sections 4, 5, and 6 to document business details and financials, including income, expenses, and assets associated with your business.

- Section 7 requires a summary of your household income and expenses. This includes all sources of income, breakdowns of spending, and other financial obligations.

- Calculate the minimum offer amount in Section 8 by following the provided formulas, utilizing your net income and asset values to determine your offer.

- Complete any additional information required in Section 9, including any relevant legal matters, and ensure you sign the form in Section 10.

- Finally, review the completed form for accuracy, save your changes, and ensure you have all required attachments before submitting your application.

Start filling out the IRS 433-A (OIC) (SP)_DSA online today to take the first step towards resolving your tax obligations.

Form 433A is California's only document that provides recorded legal notice that the home and land are conjoined as real property and may be listed and sold as such. Once recorded, it provides security to the lender, the title company and the homeowner that the home and land are one entity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.