Loading

Get Irs 941-x (pr)_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941-X (PR)_DSA online

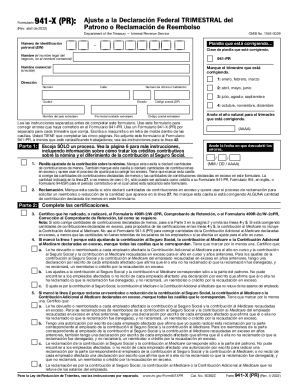

The IRS 941-X (PR)_DSA form is used to correct errors made on the IRS 941-PR quarterly tax return. Filling out this form accurately ensures that adjustments are made properly and any overpayments are claimed. This guide provides a comprehensive overview and step-by-step guidance to assist users in completing the form online.

Follow the steps to fill out the IRS 941-X (PR)_DSA online.

- Use the ‘Get Form’ button to obtain the IRS 941-X (PR)_DSA form and open it in your editing software or platform.

- Begin by entering your employer identification number (EIN) accurately in the designated field.

- Input the legal name of your business, as it appears on official documents, in the respective field. Avoid using a business name or a fictitious name.

- Select the quarter you are correcting by marking the appropriate box that corresponds to January-March, April-June, July-September, or October-December.

- Fill in the corrected year for the quarter you are amending. Ensure that you enter this information in the provided space, using the format YYYY.

- Note the date you discovered the error in the designated field using the MM/DD/YYYY format.

- Choose only one process for correction; mark the appropriate box if you are adjusting payroll tax contributions or filing a claim for a refund.

- Complete the certifications in Part 2 and ensure that you check all applicable boxes related to the corrections you are making.

- In Part 3, record the adjustments you are making for each category, ensuring to enter amounts as required in the corresponding columns for declared amounts, corrected amounts, and the differences, if applicable.

- Provide a detailed explanation of any corrections made in Part 4.

- Sign and date the form in Part 5, ensuring you provide your printed name and contact number where you can be reached during the day, along with your position at the business if applicable.

Complete your IRS 941-X (PR)_DSA form online today to ensure compliance and accurate reporting.

The 941-X is used to correct information filed on the 941 form. You will be able to download and print the 941-X to mail into the IRS. Note: The IRS does not accept eFile of the 941-X form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.