Loading

Get Bank Guarantee Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bank Guarantee Application Form online

This guide provides clear and concise instructions for completing the Bank Guarantee Application Form online. By following these steps, users can ensure that their application is filled out accurately and efficiently.

Follow the steps to complete the application form with ease.

- Click ‘Get Form’ button to obtain the Bank Guarantee Application Form and open it in your preferred online editor.

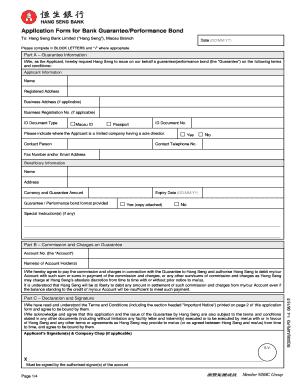

- Begin by filling out Part A, Guarantee Information. Accurately enter the Applicant Information, including your name, registered address, and if applicable, your business address and registration number.

- Provide your ID Document Type by checking the relevant box (Macau ID or Passport) and fill in the ID Document Number. If the applicant is a limited company with a sole director, indicate this by selecting 'Yes' or 'No'.

- For the Contact Person section, provide their telephone number, fax number, and/or email address.

- Complete the Beneficiary Information section by providing the beneficiary's name, address, the currency of the guarantee, and the guarantee amount.

- Specify the Expiry Date of the guarantee and indicate if a copy of the performance bond format is attached by checking 'Yes' or 'No'.

- If there are any special instructions, note them in the designated space.

- Move to Part B and fill in Commission and Charges on Guarantee. Enter the Account Number and the name(s) of the Account Holder(s).

- In Part C, Declaration and Signature, read the Terms and Conditions carefully. If you agree, sign the application on behalf of the applicant and include the company chop if applicable.

- Finally, ensure all sections are completed, then save any changes, download, print, or share the filled form as needed.

Start completing your Bank Guarantee Application Form online today!

A letter of guarantee is a document issued by your bank that ensures your supplier gets paid for the goods or services it provides to your company, in the event that your company itself can't pay. In that case, your bank will pay your supplier up to a specified amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.