Loading

Get Nj Nj-1040-hw 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-1040-HW online

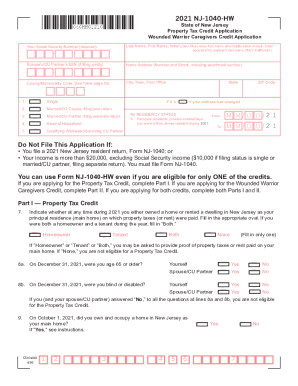

The NJ NJ-1040-HW is a crucial form for individuals applying for property tax credits or the Wounded Warrior Caregivers Credit in New Jersey. This guide provides a detailed, step-by-step process tailored to assist all users in completing the form accurately online.

Follow the steps to fill out the NJ NJ-1040-HW online successfully.

- Click ‘Get Form’ button to access the NJ NJ-1040-HW form and open it for editing.

- Enter your Social Security Number in the designated field to ensure the application is linked to your identity.

- If filing jointly, provide your partner’s Social Security Number in the appropriate space.

- Fill in your last name, first name, and middle initial. If applicable, provide the first name and middle initial of your partner, along with their last name only if it differs from yours.

- Complete your home address (including street number, apartment number if applicable, city, county/municipality code, state, and ZIP code).

- Select your filing status by indicating one of the provided options: Single, Married/CU Couple filing jointly, Married/CU Partner filing separately, Head of Household, or Qualifying Widow(er)/Surviving CU Partner.

- If you are a part-year resident, specify the months and days you resided in New Jersey during the relevant tax year.

- Indicate whether you applied for any of the credits, ensuring you complete either Part I for Property Tax Credit or Part II for the Wounded Warrior Caregivers Credit as applicable.

- In Part I, determine your residency status concerning homeownership or tenancy during 2021 by checking the correct option.

- Respond to inquiry questions related to age and disability in part I regarding yourself and your partner.

- Complete Part II by answering whether you provided care for a qualifying armed services member and provide their details if applicable.

- Finalize your application by adding your signature and the date, along with your partner’s signature if filing jointly, confirming the accuracy under penalties of perjury.

- Once all fields are filled, you can save your changes, download the form, print it, or share it as needed.

Ensure accuracy in your application by completing the NJ NJ-1040-HW online today.

The New Jersey Gross Income amount from your 2021 return can be found on line 29 of your 2021 NJ-1040 return. Please note, if the Division of Taxation has made adjustments to your return for the previous year, the amount on the . pdf of your return may not match what is on file.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.