Loading

Get Nj Nj-1040-o 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-1040-O online

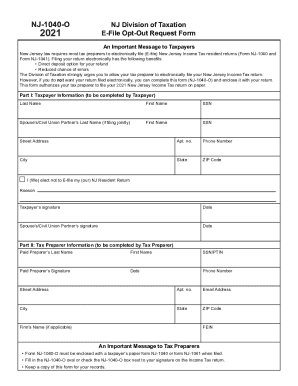

The NJ NJ-1040-O form is used by taxpayers who wish to opt out of electronic filing for their New Jersey Income Tax returns. This guide provides clear, step-by-step instructions on how to complete the form accurately and efficiently, ensuring that you can fulfill your tax obligations without difficulty.

Follow the steps to complete the NJ NJ-1040-O form online.

- Click ‘Get Form’ button to obtain the NJ NJ-1040-O form and open it in your chosen editor.

- In Part I, enter your taxpayer information. Provide your last name, first name, and Social Security Number (SSN). If you are filing jointly, also include your spouse’s or civil union partner’s last name, first name, and SSN.

- Fill in your street address, including any apartment number. Then, enter your phone number, city, state, and ZIP code.

- Indicate your election by checking the box stating, 'I (We) elect not to E-file my (our) NJ Resident Return.' You may also provide a reason for opting out.

- Sign and date the form in the designated spaces for both the taxpayer and the spouse or civil union partner, if applicable.

- In Part II, your tax preparer must complete their information including their last name, first name, SSN or PTIN, signature, and date.

- The tax preparer should provide their phone number, street address, including any apartment number, email address, city, state, and ZIP code.

- If the preparer works for a firm, the firm's name and Federal Employer Identification Number (FEIN) should also be included.

- Once the form is fully completed, save your changes. You may then download, print, or share the form as needed, ensuring to enclose it with your paper NJ-1040 or NJ-1041 return.

Take control of your tax filing; complete your forms online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The New Jersey Gross Income amount from your 2021 return can be found on line 29 of your 2021 NJ-1040 return. Please note, if the Division of Taxation has made adjustments to your return for the previous year, the amount on the . pdf of your return may not match what is on file.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.