Loading

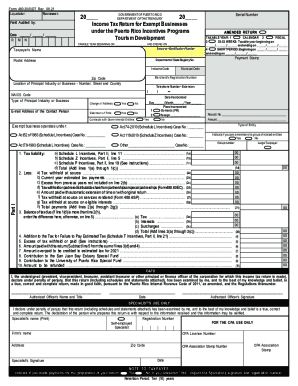

Get Pr 480.30(ii) 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.30(II) online

This guide provides comprehensive instructions for users on completing the PR 480.30(II) form online. Whether you have previous experience or are new to this process, our step-by-step approach will assist you in filling out the form accurately and efficiently.

Follow the steps to complete the PR 480.30(II) online.

- Begin by using the 'Get Form' button to access the PR 480.30(II) form and open it in the online editor.

- Fill in the tax year information: Indicate the taxable year beginning and ending dates in the specified fields. Include details such as the taxpayer's name, employer identification number, and postal address.

- Complete the section regarding your business type and entity details. You will need to provide your Department of State Registry number, industrial code, and NAICS code.

- If applicable, indicate whether you are filing an amended return and fill in the relevant details based on your filing situation.

- Proceed to sections related to tax liability. Input your income details, including various tax incentives and amounts withheld at the source. Be meticulous in calculating total payments and balances due.

- Fill in the oath section, where an authorized officer must declare that the information presented is accurate and complete. Ensure the officer's name, title, and signature are correctly entered.

- After completing all sections, review the entire form for accuracy. Make required corrections if needed.

- Finally, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your PR 480.30(II) form online today for a smooth filing experience.

To request a Puerto Rico extension, file Form AS 2644 (Request for Extension of Time to File the Income Tax Return) by the original due date of your return. Form AS 2644 will give you 3 extra months to file your return, moving the filing deadline to July 15 (for calendar year taxpayers).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.