Loading

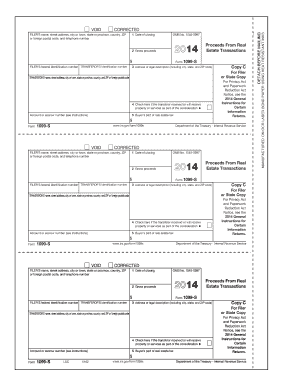

Get Form 1099-s 2014 Proceeds From Real Estate Transactions Copy C ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1099-S 2014 Proceeds From Real Estate Transactions Copy C online

Filling out Form 1099-S can be straightforward when you understand its components. This guide provides clear, step-by-step instructions designed to help you complete the 2014 version of the form accurately and efficiently.

Follow the steps to complete your Form 1099-S online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the 'Date of closing' in the appropriate field, which indicates when the real estate transaction took place.

- In the 'Filer's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number' section, provide your full contact information.

- Input the 'Filer's federal identification number' to identify your entity for tax purposes.

- Fill in the 'Transferor’s identification number' which is necessary for tracking the transaction by the transferor.

- Complete the 'Transferor’s name, street address, city or town, state or province, country, and ZIP or foreign postal code' section with the transferor's full information.

- In the 'Address or legal description (including city, state, and ZIP code)' field, include the legal description or address of the real estate involved in the transaction.

- Provide the 'Gross proceeds' amount representing the total amount received from the transaction.

- Check the box if the transferor received or will receive property or services as part of the consideration.

- Include any 'Buyer's part of real estate tax' in the designated field, as applicable.

- Add the 'Account or escrow number' if required based on your instructions.

- Review all the information entered for accuracy before finalizing the document.

- Once you have verified that all information is correct, you can save changes, download, print, or share the completed form.

Take the next step in your digital document management by completing Form 1099-S online today.

IRS Form 1099-S Proceeds From Real Estate Transactions is used to report proceeds from real estate transactions. ... If the 1099-S was for the sale of your main home, complete the Sale of Home questions under the Investment Income topic in our program to see if any amounts are taxable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.