Loading

Get Iowa Fiduciary Forms 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iowa Fiduciary Forms 2012 online

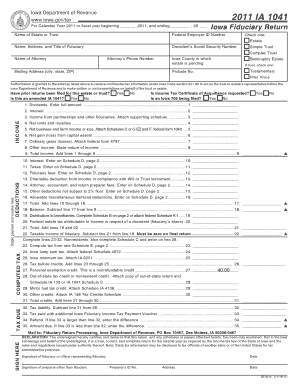

Filling out the Iowa Fiduciary Forms for 2012 can be a straightforward process when approached step by step. This guide will walk you through the essential components of the form, ensuring a clear understanding of how to efficiently complete it online.

Follow the steps to complete the Iowa Fiduciary Forms 2012 online.

- Press the ‘Get Form’ button to access the Iowa Fiduciary Forms and open it in your online document editor.

- Begin by filling in the name of the estate or trust in the designated field.

- Enter the Federal Employer Identification Number (EIN) for tax identification.

- Provide the name, address, and title of the fiduciary.

- Input the decedent’s Social Security number in the appropriate section.

- Select the type of entity by checking the relevant box: 'Estate', 'Simple Trust', or 'Complex Trust'.

- Fill in the name and contact details of the attorney representing the estate or trust, including their phone number.

- Indicate the Iowa County where the estate proceedings are taking place.

- If applicable, fill in the details for the bankruptcy estate and select the appropriate type by checking the box.

- Complete the Authorization section by affirming that the listed attorney is allowed to receive confidential tax information.

- Answer the questions regarding prior returns and if this is an amended IA 1041 by checking 'Yes' or 'No'.

- Proceed to fill out the income section, entering amounts for dividends, interest, income from partnerships, net rents, business income, and other income sources as applicable.

- Total all income from lines 1 through 8.

- Move onto the deductions section, entering figures for fiduciary fees, taxes, and other relevant deductions.

- Calculate the total deductions and determine the taxable income of the fiduciary.

- Complete the computed tax section and enter the appropriate figures according to the tax computation guidelines.

- After verifying all information entered, save the changes made to the form, and proceed to download or print.

- If necessary, share the completed form with the relevant parties.

Complete your Iowa Fiduciary Forms online today!

The Iowa Trust and Estate rates are the same as individual tax rates, with the rate ranging from . 36% to 8.98% for taxable income over $71,910. The rate schedule for trusts and estates are the same as for single individuals. Iowa does not have a special capital gains tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.