Loading

Get Vat1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat1 Form online

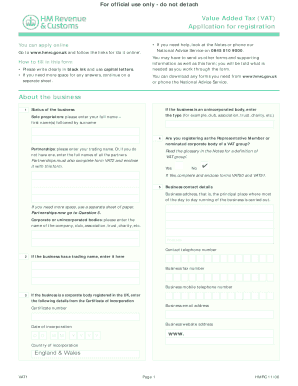

Filling out the Vat1 Form is an essential step in the application for VAT registration. This guide will provide you with clear instructions to complete the form efficiently, ensuring that you have the necessary information at hand throughout the process.

Follow the steps to complete your Vat1 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering information about your business. If it is an unincorporated body, specify the type (club, association, trust, etc.). Sole proprietors should provide their full name, including first names and surname.

- If your business is a partnership, enter the trading name. If one is not available, list the full names of all partners. Complete form VAT2 and enclose it if applicable.

- Indicate whether you are registering as the Representative Member of a VAT group. If yes, include forms VAT50 and VAT51.

- Fill in the business contact details. Provide the main business address and enter the postcode. Include contact numbers and email address, ensuring that all fields are completed accurately.

- Describe the primary business activities. If these activities are land or property-related, complete and enclose form VAT1614.

- Answer questions related to previous business involvement and effective registration dates, providing any necessary information for each question.

- Indicate if you are applying for voluntary registration due to turnover being below the threshold. Fill in the estimates as required if applicable.

- Complete details about your expected turnover and any exempt supplies as well as your buying and selling activities in relation to EU member states.

- Provide your personal details for the applicant section, including name, home address, date of birth, and National Insurance number.

- Sign the declaration section, ensuring that all information submitted is accurate. Include the capacity in which you are signing if applicable.

- Finally, review your completed form for any missing information. Once satisfied, save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your Vat1 Form online today to ensure a smooth registration process.

VAT1 FORM- registering for VAT correctly. Whether you are registering for VAT because you have reached the annual VAT threshold or you are doing it voluntarily, you must fill out VAT1 form. You can choose between submitting it online or downloading a copy, filling it and posting it to HMRC .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.