Loading

Get Form 8655 Quickbooks

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8655 Quickbooks online

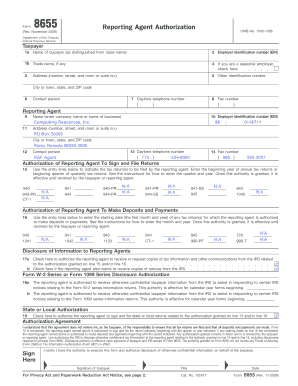

Form 8655 is an important document used to authorize a reporting agent to manage specific tax returns on behalf of a taxpayer. Completing this form accurately ensures that your reporting agent has the necessary authority to act in your stead for tax matters.

Follow the steps to successfully complete the Form 8655

- Click the ‘Get Form’ button to obtain the form and open it in the designated editing tool.

- Begin filling out the form with the taxpayer’s details. Enter the taxpayer's name, employer identification number (EIN), and trade name if applicable. Ensure that the contact information, including the address and daytime telephone number, is correctly entered.

- Provide the reporting agent’s information. Include the reporting agent’s name, EIN, contact details, and address in the appropriate fields.

- In section 15, indicate which tax returns your reporting agent is authorized to sign and file. Use the specified formats: 'YYYY' for annual returns and 'MM/YYYY' for quarterly returns.

- In section 16, enter the start date for the reporting agent's authority to make deposits or payments related to the tax returns specified.

- Utilize section 17 to grant permission for the reporting agent to receive or request copies of tax-related communications from the IRS.

- Sign the form in the designated 'Sign Here' area, ensuring to provide the date and title, if applicable, confirming your authorization for disclosure of information.

- Finally, review all entries for accuracy. Once satisfied, you can choose to save changes, download, print, or share the completed form as needed.

Complete and submit your Form 8655 online to ensure a smooth authorization process!

The IRS typically processes Form 8655 within a few weeks, but processing times can vary based on their workload. It is important to submit your form accurately to avoid delays. By utilizing Form 8655 Quickbooks, you can ensure that your submission is correct and complete, potentially speeding up the processing time. Always keep track of your submission date for reference.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.