Get Customer Credit Evaluation Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Customer Credit Evaluation Form online

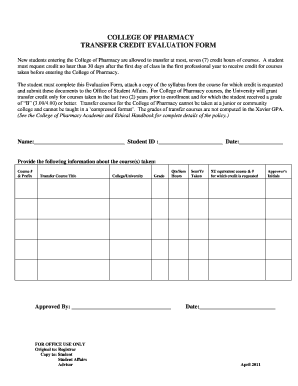

Completing the Customer Credit Evaluation Form online is a straightforward process that allows new students in the College of Pharmacy to request transfer credits for previous coursework. This guide provides step-by-step instructions to help you navigate the form with ease.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by entering your name, student ID, and the date in the designated fields at the top of the form. Ensure that all information is accurate to avoid processing delays.

- In the section provided, list the course number and prefix of the transfer courses you are submitting for evaluation. This information is essential for identifying the courses you wish to transfer.

- Fill in the transfer course title, the college or university where these courses were taken, and the grade received. Ensure that the grade reflects a 'B' (3.00/4.00) or better, as only these grades are eligible for transfer.

- Indicate the quarter or semester hours and the semester or year in which the course was taken. This provides context and timing for the evaluation of your transfer credit.

- Next, specify the equivalent course at Xavier University (XU) for which you are requesting credit. Include the course number to ensure that the evaluation aligns with the program’s requirements.

- Once you have filled out all the necessary fields, review your entries for accuracy. Consider attaching a copy of the syllabus from each course for which credit is requested, as required.

- Finally, you may need to obtain approval from a designated individual within the Office of Student Affairs. Ensure that any required signatures are collected.

- After completing all sections of the form, save your changes. You can then download, print, or share the completed form as needed. Ensure you submit the form along with the syllabus within the stipulated timeframe.

Take the next step in your academic journey by completing the Customer Credit Evaluation Form online today.

Related links form

Conducting a credit evaluation involves reviewing your credit report, assessing your credit score, and analyzing your financial history. You can utilize the Customer Credit Evaluation Form to gather all necessary information systematically. This form helps you consolidate your data, making it easier to understand your credit standing and identify areas for improvement.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.