Get Kentucky Department Of Revnue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kentucky Department Of Revenue online

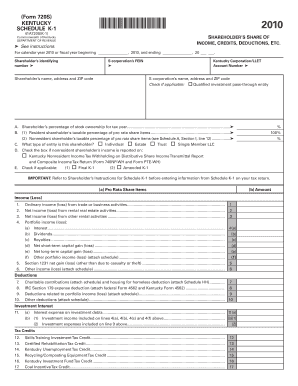

This guide provides clear instructions for users on how to accurately complete the Kentucky Department of Revenue Form 720S, also known as Schedule K-1. By following these steps, users can ensure that their tax information is reported correctly and efficiently.

Follow the steps to successfully complete Schedule K-1 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the calendar year or fiscal year information at the top of the form. This indicates the reporting period for the shareholder's information.

- Fill in the shareholder’s identifying number and the S corporation's Federal Employer Identification Number (FEIN) as required.

- Provide the shareholder’s name, address, and ZIP code to ensure proper identification for tax purposes.

- Input the Kentucky Corporation/LLET account number as it relates to the S corporation.

- Enter the S corporation’s name, address, and ZIP code. This identifies the source of the income being reported.

- Indicate if the shareholder qualifies as an investment pass-through entity by checking the applicable box.

- Record the shareholder's percentage of stock ownership for the tax year, ensuring it totals 100%.

- Input the taxable percentages for resident and nonresident shareholders respectively in the specified fields.

- Identify the type of entity for the shareholder from the given options such as individual, estate, trust, or single member LLC.

- Complete additional relevant sections regarding tax credits and deductions as detailed in the form. Ensure any schedules that are needed are attached.

- Review all entries for accuracy and completeness before finalizing the submission.

- At the end, save changes, download, print, or share the form as necessary for your records.

Complete your Schedule K-1 online to ensure your tax information is accurately reported!

If you need to mail documents to the Kentucky Department of Revenue, you should send them to the appropriate address listed on their official website. The address may vary depending on the type of document you are submitting, such as tax returns or inquiries. To avoid delays, double-check that all forms are complete and accurately filled out. You can also use our platform for help with any mailing-related questions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.