Loading

Get 709 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 709 Form online

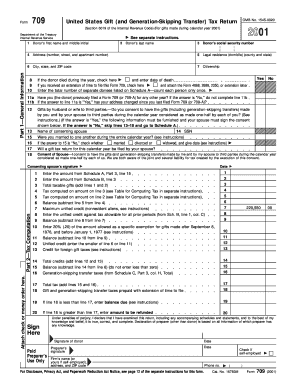

The 709 Form, officially known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is an important document for individuals who have made taxable gifts. This guide provides clear, step-by-step instructions on how to complete this form online, ensuring a smooth and error-free process.

Follow the steps to effectively complete the 709 Form online.

- Press the ‘Get Form’ button to access the 709 Form and open it in your preferred online editor.

- Begin by filling out Part 1—General Information. Enter the donor’s first and last names, social security number, address, and legal residence. Ensure that all information is accurate as it establishes the donor's identity.

- Respond to questions regarding the donor’s citizenship and if they have passed away during the year. If applicable, check the appropriate boxes and provide any necessary information.

- Indicate if you received an extension of time to file and attach the relevant extension form if needed. Ensure you accurately represent any previous filings of the 709 Form.

- Proceed to Part 2—Tax Computation. Here, you will calculate the total taxable gifts and any associated taxes. Follow the provided lines meticulously, entering values as prompted.

- In Part 3, include relevant information related to generation-skipping transfers, if any, based on Schedule C from your completed forms. Make sure this aligns with any previously submitted information.

- Review all sections of the form for accuracy before finalizing. Once you are satisfied with the information you have provided, save your changes.

- After reviewing, you may choose to download, print, or share the completed 709 Form as necessary for your records and submission.

Complete your 709 Form online today to ensure compliance with gift tax obligations.

Yes, there is tax software available that supports the preparation of Form 709. Many reputable software options include guidance and checks to help you navigate the complexities of gift tax regulations. Using such software can simplify the process and minimize errors, so you can focus on what matters most.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.