Loading

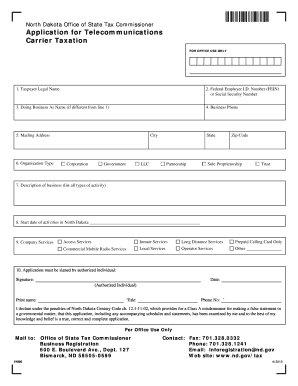

Get Application For Telecommunication Carriers Taxation - Nd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Telecommunication Carriers Taxation - Nd online

Filling out the Application For Telecommunication Carriers Taxation - Nd online can be a straightforward process if you follow the right steps. This guide will provide you with a comprehensive overview of how to effectively complete this form and ensure that all necessary information is provided.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the taxpayer legal name in the respective field at the top of the form.

- Provide the Federal Employer Identification Number (FEIN) or Social Security Number in the designated section.

- If applicable, fill in the 'Doing Business As' name that differs from the legal name provided in step 2.

- Enter the business phone number to ensure contact availability.

- Fill in the mailing address, including city, state, and zip code, ensuring accuracy for future correspondence.

- Select the organization type from the options provided (e.g., Corporation, LLC, Sole Proprietorship) by marking the appropriate choice.

- In the description of business section, list all types of activities conducted, ensuring all relevant services are included.

- Specify the start date of activities conducted in North Dakota to maintain accurate records of business operations.

- Indicate the company's services by checking the relevant boxes (e.g., Local Services, Long Distance Services), and any additional services can be noted in the 'Other' field.

- Ensure the application is signed by an authorized individual, who will also provide their printed name, title, and phone number.

- Review all the information entered for accuracy before finalizing the form.

- Save the changes made to the form, and then choose to download, print, or share it as necessary.

Complete your documents online today to ensure timely compliance with the telecommunication taxation requirements.

Form 306 – Income Tax Withholding Return must be filed even if an employer did not pay any wages during the period covered by the return. Form 307 – North Dakota Transmittal of Wage and Tax Statement needs to be submitted by anyone who has an open withholding account with the Office of State Tax Commissioner.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.