Loading

Get 20092106form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 20092106form online

Filling out the 20092106form online can be a straightforward process if you approach it step by step. This guide will help you navigate through each section of the form and ensure that all required information is accurately provided.

Follow the steps to successfully complete the 20092106form online.

- Click the ‘Get Form’ button to initiate the process and access the form in the online editor.

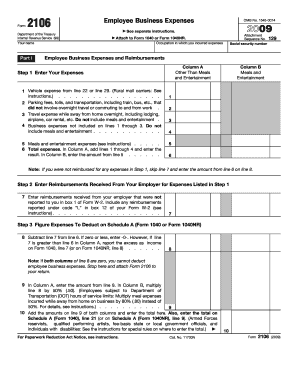

- Enter your name and social security number at the top of the form as required. Make sure your name matches the one used for your tax records.

- In Part I, begin by categorizing your employee business expenses. Start with vehicle expenses, followed by parking fees and other transportation costs. Clearly itemize each section.

- Next, report on any travel expenses incurred while away from home overnight, including all necessary costs such as lodging and transportation.

- Calculate your total expenses for Column A by summing the values from lines 1 to 4. Document your meals and entertainment expenses in Column B accurately.

- Move to Step 3 to determine the deductibility of your expenses by completing the necessary calculations. Ensure to cross-reference all figures.

Complete your 20092106form online today to ensure your employee business expenses are accurately documented.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.