Loading

Get Taxable Calculation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxable Calculation online

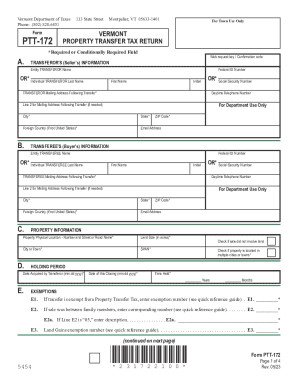

Filling out the Taxable Calculation form is an essential step in reporting property transfer tax information. This guide provides clear and detailed steps to help users navigate the form efficiently and accurately.

Follow the steps to successfully complete your Taxable Calculation form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by inputting the web request key or confirmation code if available, then proceed to the section for the transferor's (seller's) information. Fill in the entity or individual transferor's name, federal ID number or social security number, and the mailing address following the transfer.

- Next, provide the transferee's (buyer's) information in a similar manner as the transferor, including their mailing address and contact details.

- In the property information section, enter the physical location of the property, land size in acres, city or town, and the SPAN if applicable. Mark whether the sale did not involve land or if the property is located in multiple cities or towns.

- Fill in the holding period details including the date the transferor acquired the property, the date of the closing, and time held in years and months.

- For exemptions, enter any applicable exemption numbers and descriptions as specified, particularly for transfers between family members if applicable.

- Complete the transfer information section by providing details on how the transferor acquired the property, the interest conveyed, and answers to any relevant questions regarding building construction.

- Answer questions in the agricultural/managed forest land use value program section to confirm if the property is enrolled in the Current Use Program.

- Proceed to the real estate withholding certification, ensuring to indicate if the Vermont income tax has been withheld and provide any necessary exemption numbers.

- Lastly, complete the tax calculation section by entering values as required and calculating the total tax due based on the portions eligible for special rates and the general rate.

- Once all sections are completed, review your information for accuracy. You can then save changes, download, print, or share the form as needed.

Complete your Taxable Calculation form online today to ensure timely submission.

When written out, the equation looks like this: Sales tax rate = Sales tax percent / 100. Sales tax = List price x Sales tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.