Get Or Oq Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Or Oq Report online

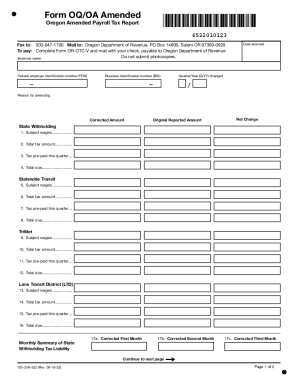

Filling out the Or Oq Report online can be a straightforward process if you follow the right steps. This guide provides detailed instructions to help you complete the Oregon Amended Payroll Tax Report with confidence.

Follow the steps to accurately complete your Or Oq Report online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the business name in the appropriate field, ensuring it matches your registered name.

- Provide your federal employer identification number (FEIN) in the designated area.

- Fill in your business identification number (BIN) accordingly.

- Record the date when the form is being submitted.

- Indicate the quarter and year (Q/YY) that are relevant to the report changes.

- Specify the reason for amending the report clearly.

- List the corrected amount and original reported amount for each applicable section.

- Calculate the net change by subtracting the original reported amount from the corrected amount.

- Complete the sections on state withholding, statewide transit, TriMet, and Lane Transit District by entering the subject wages, total tax amounts, tax pre-paid, and total due.

- For unemployment insurance, enter the subject wages, excess wages, taxable wages, UI tax rate, and total due.

- Complete the paid leave section by providing subject wages, excess wages, taxable wages, and both employer and employee contributions.

- Fill out the workers’ benefit fund assessment section with hours worked, assessment rate, and total assessment due.

- Provide the number of UI workers for each of the first three months.

- Indicate the number of out-of-state employees and replacement workers in the paid leave section.

- Under penalty of false swearing, date and sign the report indicating your declaration of truthfulness.

- Finally, fill in the preparer name, phone number, and license number if applicable.

- Once all fields are completed, users can save changes, download, print, or share the completed form as needed.

Complete your Or Oq Report online today for efficient filing.

Payment and other information OQOregon Department of Revenue PO Box 14800, Salem, OR 97309-0920Schedule BOregon Department of Revenue PO Box 14800, Salem, OR 97309-0920WROregon Department of Revenue PO Box 14260, Salem, OR 97309-5060STT-1Oregon Department of Revenue PO Box 14800, Salem, OR 97309-09203 more rows Oregon payroll tax form information Canada https://cs.thomsonreuters.com › tax_processing › states Canada https://cs.thomsonreuters.com › tax_processing › states

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.