Loading

Get F5695

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F5695 online

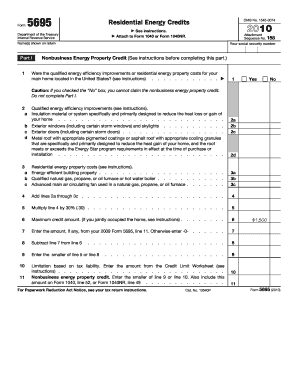

Filling out Form 5695, which is used to claim residential energy credits, can be straightforward with the right guidance. This guide will provide you with clear, step-by-step instructions tailored to assist you in completing the form online effectively.

Follow the steps to complete your F5695 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name(s) shown on your return at the top of the form. Ensure this matches your IRS Form 1040 or 1040NR.

- Provide your social security number in the designated field to identify yourself on the form.

- In Part I, answer the question about whether the improvements or property costs were for your main home located in the United States by checking 'Yes' or 'No'. If 'No,' skip to the end of the form.

- Input the amounts for qualified energy efficiency improvements in Lines 2a through 2d. This includes insulation, windows, doors, and roof costs that meet certain criteria.

- Complete Lines 3a through 3c for residential energy property costs, including relevant equipment purchases like efficient furnaces or water heaters.

- Add the total from Lines 2a to 3c on Line 4, then calculate 30% of this total on Line 5.

- On Line 6, input the maximum credit amount based on your joint occupancy situation if applicable.

- If you have a credit carryforward from the previous year, enter the amount on Line 7 and calculate the value to be entered on Line 8.

- Finalize by entering the smaller of the amounts from Lines 5 or 8 on Line 9 and proceed to Part II if applicable.

Complete your F5695 online today to take advantage of valuable energy credits.

Filing Form 56F requires understanding its specific instructions, which differ slightly from Form 56. Prepare the form with the necessary information about your fiduciary responsibilities. When you're ready, submit it to the IRS following the established guidelines—using tools from US Legal Forms can help simplify the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.