Get Further Statement Of Organization Claiming Property Tax Exemption (n - Trentonnj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FURTHER STATEMENT OF ORGANIZATION CLAIMING PROPERTY TAX EXEMPTION (N - Trentonnj) online

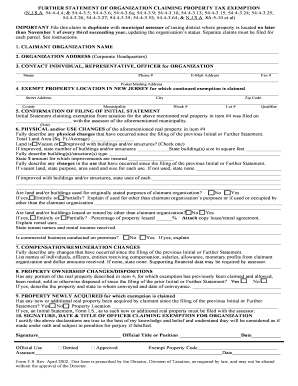

This guide provides detailed, step-by-step instructions for completing the Further Statement of Organization Claiming Property Tax Exemption (N - Trentonnj) form online. By following these instructions, users can ensure their form is accurately filled out and submitted in compliance with state requirements.

Follow the steps to successfully complete your property tax exemption claim.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, enter the name of your organization in the 'Claimant Organization Name' field.

- Next, provide the organization’s corporate headquarters address in the 'Organization Address' section.

- Identify a contact individual for the organization in the relevant field, including their phone number, email address, and fax number.

- Complete the 'Exempt Property Location' section by filling in the street address, city, zip code, county, municipality, block number, lot number, and qualifier.

- Confirm the filing of the initial statement in item #5 by entering the date it was filed with the municipal assessor.

- In section #6, describe any physical changes to the property since the last filing, including total land area and whether the land is vacant or improved. If improved, include the number of buildings, their size, and a description of each.

- Provide details about the current use of the property, confirming if the land/buildings are used for the organization’s originally stated purposes.

- Indicate if any part of the land/buildings is leased, along with the terms and percentage of leased property.

- Detail any changes to compensation or remuneration for individuals associated with the organization in section #7.

- Answer questions about property ownership changes in section #8, stating if any part of the property has been rented, sold, or conveyed.

- In section #9, indicate if any new property has been acquired since the last filing.

- Finally, provide the signature, date, and title of the officer claiming exemption for the organization, certifying the truthfulness of the declarations made.

- Review the completed form, make any necessary updates, and then save, download, print, or share the form as needed.

Complete your document online today to ensure timely submission for your property tax exemption claim.

Getting your property tax statement in NJ is straightforward. You can access it online through your municipality's official website, or visit the tax collector's office in person. This is especially important if you are completing the FURTHER STATEMENT OF ORGANIZATION CLAIMING PROPERTY TAX EXEMPTION (N - Trentonnj), to ensure your documents are consistent and accurate.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.