Loading

Get De 200-02-x Instructions 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the DE 200-02-X Instructions online

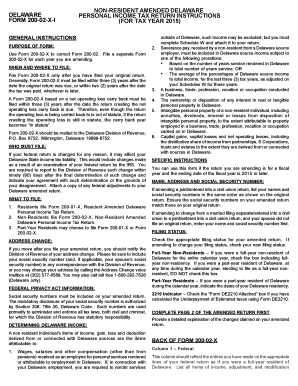

Filling out the DE 200-02-X Instructions online is a crucial step for amending your Delaware non-resident personal income tax return. This guide aims to provide clear and supportive instructions for successfully completing the form with confidence.

Follow the steps to fill out the DE 200-02-X Instructions online effectively.

- Click the ‘Get Form’ button to access the form and open it in your editor.

- Ensure you have filed the original return before submitting the DE 200-02-X. Remember, it should be filed within three years after the original return's due date or two years after the tax payment date, whichever is later.

- Provide your name, address, and social security number accurately. If amending a joint return, align the names and numbers as shown on the original return.

- Indicate your filing status by checking the appropriate box. For full-year non-residents or part-year residents, mark according to your residency during the tax year.

- Complete Page 2 of the amended return first, ensuring you detail any changes in your income or deductions relevant to your Delaware tax liability.

- On the back of the form, fill out both columns for federal and Delaware source income. Be mindful to list all income from Delaware sources in Column 2 while ensuring Column 1 mirrors your federal entries.

- Provide specific entries for various income types, such as wages, business income, capital gains, etc., in accordance with the provided line instructions. Complete each line with the necessary details to ensure accuracy.

- After filling out all sections, review the form for completeness and accuracy. Make sure all required attachments, such as W-2 forms and explanations for changes, are included.

- Once everything is complete, you can either save the changes, download the form, print it, or share the amended document as necessary.

Complete your DE 200-02-X Instructions online today to ensure your tax amendments are processed smoothly.

Form 200-02 is an amended tax return form for part-time or non-residents who are filing a Delaware income tax return. Form 200-01 is the default income tax return form for Delaware residents. This application allows you to file for an automatic extension of time to file your Delaware Individual Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.