Loading

Get De 200-02-x Instructions 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the DE 200-02-X Instructions online

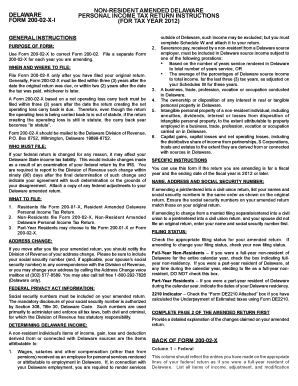

This guide provides a comprehensive overview of how to complete the DE 200-02-X Instructions online. It will walk you through each section and field of the form, ensuring that you understand every aspect of the process.

Follow the steps to efficiently fill out the DE 200-02-X Instructions.

- Click the ‘Get Form’ button to access the DE 200-02-X Instructions and open it in the document editor.

- Begin by filling out your name, address, and social security number as listed on your original return. Ensure that this information is accurate and matches what was previously submitted.

- Select your filing status by checking the appropriate box according to your situation, whether you are a full-year non-resident, part-year resident, or have changed your filing status.

- Proceed to the second page of the form and provide a detailed explanation of the changes you are claiming. Clarity here is essential for processing your amendment.

- As you fill out the back of the form, list all relevant income, gains, losses, and adjustments in the provided columns, ensuring they reflect your federal return accurately.

- Complete the lines regarding deductions and credits. Pay particular attention to providing any required supporting schedules if you are claiming specific adjustments.

- Review your entries for accuracy and consistency with your original return, making corrections where necessary.

- Once you have completed the form, you will have the option to save your changes, download a copy of your amended return, print it, or share it as needed.

Be sure to complete your DE 200-02-X Instructions online to ensure a smooth amendment process.

If additional tax is due, file Form 1027, Application for Automatic Extension of Time to File Delaware Individual Income Tax Return, by May 2, to request an extension to October 16.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.