Loading

Get Pr Form 480.20(u) 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR Form 480.20(U) online

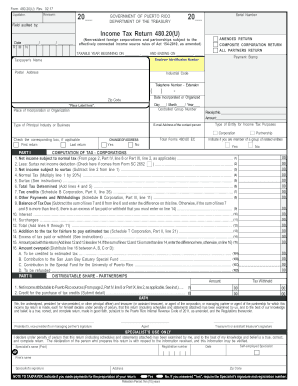

This guide provides a detailed, step-by-step approach to filling out the PR Form 480.20(U) online. Designed for nonresident foreign corporations and partnerships, it ensures that users can navigate the form efficiently, regardless of their prior legal experience.

Follow the steps to successfully complete your PR Form 480.20(U) online.

- Press the ‘Get Form’ button to retrieve the PR Form 480.20(U) and open it in your preferred editor.

- Fill in the header section with the applicable details, including the date, tax year, and taxpayer information such as name, address, and employer identification number.

- Indicate if the return is amended or if it is a composite corporation return by checking the appropriate box.

- Provide the net income subject to normal tax as indicated in Part I. This requires inputting the figures from the relevant sections of the form.

- Complete the computation of tax by calculating the normal tax rate applied to your net income, as well as any surtax deductions if applicable.

- For partnerships, complete Part II by indicating the distributable share amounts and any applicable tax withheld details.

- Review additional sections such as Part IV onward, which includes details on net income attributable to Puerto Rico sources, property factor, payroll factor, and computations regarding sales and purchases.

- Finalize the document by having the requisite signatures on the oath section, ensuring the return is validated under penalty of perjury.

- After completing the form, you can save your changes digitally, download the filled form, print it, or share it as necessary.

Start completing your PR Form 480.20(U) online today to ensure timely and correct submission.

Series 480.6A reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. This form will also report any interest paid out in your cash account. Series 480.6D reports any tax exempt dividends that were distributed in your taxable investment account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.