Loading

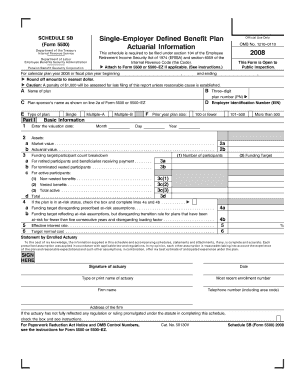

Get Schedule S B 2012 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule S B 2012 form online

This guide provides clear and comprehensive instructions for filling out the Schedule S B 2012 form online. Whether you are new to digital document management or have some experience, you will find this guide supportive and easy to follow.

Follow the steps to complete the Schedule S B 2012 form effectively.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin with Part II, where you will enter the beginning of year carryover and prefunding balances. Input the carryover balance, prefunding balance, and any applicable adjustments necessary from the prior year.

- In Part III, fill out the funding percentages. Enter the funding target attainment percentage and the adjusted funding target attainment percentage for the current year.

- Proceed to Part IV, where you will document contributions made by both employers and employees. Record dates and amounts accurately for proper tracking.

- In Part V, specify the assumptions used to determine the funding target and target normal cost. This includes entering segment rates and applicable months.

- Complete Part VI, noting any changes made to actuarial assumptions or methods, and provide any attachments if necessary.

- In Part VII, reconcile any unpaid minimum required contributions from prior years, ensuring all calculations are accurate.

- Finalize your entries in Part VIII, determining the total funding requirement and recording any carryover or prefunding balances.

- Once all sections are completed, save the changes made to the form. You may then choose to download, print, or share the completed form as needed.

Start completing your documents online today for a streamlined experience.

Related links form

Certain plans may be exempt from filing Form 5500, including some small plans and those not covered by ERISA. For example, plans with fewer than 100 participants often qualify for exemption, as do some church and governmental plans. Understanding these exemptions is beneficial to strategically address your filing requirements for the Schedule S B 2012 Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.