Loading

Get Vt Mrt-441 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT MRT-441 online

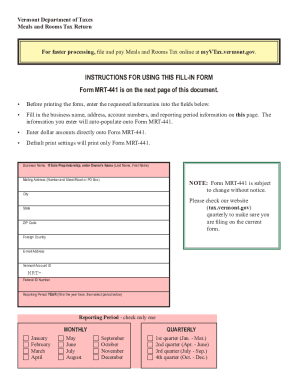

The Vermont Meals and Rooms Tax Return, known as form MRT-441, is essential for reporting and paying the applicable taxes related to meals and rooms in Vermont. This guide provides step-by-step instructions for completing the form online, ensuring a smooth filing process.

Follow the steps to complete the VT MRT-441 online.

- Click the 'Get Form' button to access the online form and open it for editing.

- Enter the business name and, if applicable, the owner’s name in the designated field. This is essential for proper identification.

- Fill in the mailing address, including the number and street/road or PO Box, along with the city, state, and ZIP code to ensure accurate correspondence.

- Input the Vermont Account ID and Federal ID Number in their respective fields, as this information is necessary for the state’s tax records.

- Select the reporting period by filling in the year and checking the appropriate box for either monthly or quarterly reporting.

- In Part I, provide the total amounts for meals, rent, and alcohol, along with the exempt amounts where applicable, to determine the net taxable amounts.

- Calculate the taxes due by multiplying the net taxable amounts by the respective tax rates and enter this information in the corresponding fields.

- In Part III, calculate totals for meals and rooms tax due, local option tax due, and the overall total tax due by adding the appropriate lines.

- Complete the certification section by signing and dating the form, and providing contact details for the preparer if applicable.

- Finally, save your changes, and you may choose to download, print, or share the completed form as necessary.

Complete the VT MRT-441 online today for efficient tax reporting.

As of November 2022, the Vermont Department of Taxes will only accept returns from businesses who collect and report Local Option Tax if they are filed electronically. Local option tax is calculated as 1% of the taxable (net) sales for each town.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.