Loading

Get Omb No 1545 0074

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OMB No 1545 0074 online

This guide provides a clear and supportive method for completing the Omb No 1545 0074 form online. Whether you are filing for yourself or a partner, following these steps will help ensure your submission is accurate and efficient.

Follow the steps to successfully complete the Omb No 1545 0074 form.

- Click the ‘Get Form’ button to access the schedule R document. This allows you to retrieve the form and make it available for online editing.

- Enter the name(s) shown on your Form 1040 in the designated field. This should match the names associated with your tax identification.

- Input your Social Security number in the appropriate section on the form, ensuring that it is accurate to prevent processing delays.

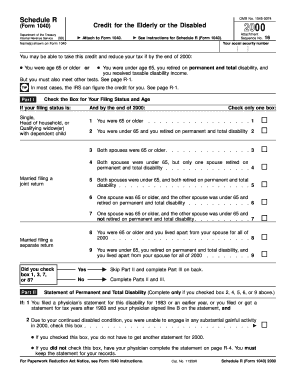

- Review the filing status checkboxes in Part I. Initiate by selecting the appropriate box based on your age and filing status. Each option provides specific criteria that must be met to qualify for the credit.

- If applicable, check the necessary box in Part II regarding your permanent and total disability status. This will determine if you should skip to Part III or complete the following sections.

- Complete the Statement of Permanent and Total Disability if you indicated any relevant boxes in Part I regarding your disability status. This may require input from a physician.

- Proceed to Part III and calculate your credit as instructed. Enter the amounts as indicated, carefully following the guidance provided within the relevant lines.

- After completing all sections, review your entries to ensure accuracy. Then, you can save your changes, download the completed form, print it, or share it as needed.

Complete your documents online today and ensure your eligibility for the credit.

When deciding whether to claim 0 or 1 on your W4, consider how much tax you want withheld from your paycheck. Claiming 0 results in a higher withholding rate and possibly a larger refund, while claiming 1 lowers the withholding amount. Review your financial circumstances and consult the guidance related to OMB No 1545 0074 to make the best choice. Using USLegalForms can help clarify which option suits your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.