Loading

Get Vt Wht-436 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT WHT-436 online

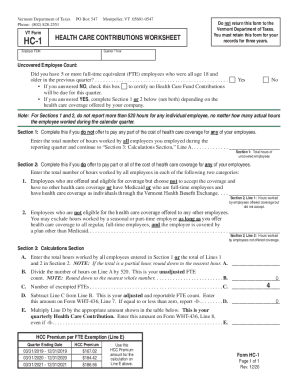

The VT WHT-436 is an essential form for reporting quarterly withholding and health care contributions in Vermont. This guide provides clear, step-by-step instructions on how to successfully complete this form online, ensuring that all necessary information is accurately captured.

Follow the steps to fill out the VT WHT-436 online effectively

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide your business name in the designated field.

- Enter your Federal ID Number accurately.

- Fill in the address information, including city, state, and ZIP code. If applicable, include the foreign country.

- Select the appropriate reporting period by checking only one of the provided boxes for year and quarter.

- In Part I, input the total number of full-time and part-time employees as of the last day of the quarter.

- Complete the wage withholding section by entering total Vermont wages paid and total Vermont tax withheld.

- In Part II, fill in the non-wage withholding section with total non-wage payments and total Vermont tax withheld from those payments.

- Sum up the total Vermont tax withheld for the quarter and report this figure.

- In Part III, if applicable, certify if no health care contribution is due, otherwise provide the adjusted uncovered FTE and total health care contributions due from the HC-1.

- Calculate total due by adding the figures from the balance section.

- Sign and date the form, including contact information and preparer’s signature if using a tax professional.

Complete your VT WHT-436 form online today for a seamless filing experience!

Exemption From Withholding To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it's furnished to the employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.