Loading

Get Schedule C Pdf Filler

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule C Pdf Filler online

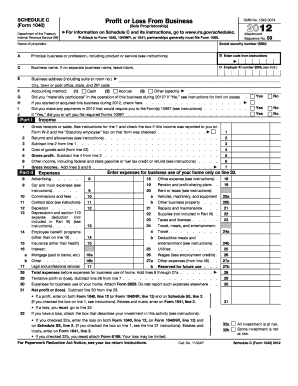

The Schedule C Pdf Filler is an essential document for reporting profit or loss from a sole proprietorship. This guide provides a clear and supportive step-by-step approach to fill out the form online, ensuring you complete it accurately.

Follow the steps to effectively complete the Schedule C Pdf Filler.

- Click the ‘Get Form’ button to access the Schedule C Pdf Filler and open it in the online editing tool.

- Enter the name of the proprietor in the designated field. Make sure to use their full legal name.

- Fill in the social security number (SSN) for the proprietor. This information is essential for identification purposes.

- Indicate the principal business or profession by providing a brief description of the services or products offered.

- If applicable, input the business name in the next field. If no separate business name exists, leave this section blank.

- Complete the business address section, including any suite or room numbers, city, state, and ZIP code.

- Select the accounting method used for the business by choosing between cash, accrual, or other methods as specified.

- Indicate whether the proprietor materially participated in the business operations during the year. If 'No,' refer to the instructions regarding loss limits.

- Indicate if the business was started or acquired during the year by checking the corresponding box.

- Report the gross receipts or sales for the business. Include any relevant information, such as if this income was reported on a Form W-2.

- Detail any returns and allowances that apply to the income reported.

- Subtract the returns and allowances from the gross receipts to determine the net income.

- Calculate and report the cost of goods sold as applicable, ensuring to include all necessary details.

- Complete the section detailing expenses, making sure to provide comprehensive information regarding each type of expense, such as advertising, car expenses, and others listed.

- After entering all required information, review the completed form for accuracy.

- Once satisfied, save changes to the document. You may also choose to download, print, or share the filled form as needed.

Start filling out your Schedule C Pdf Filler online today to ensure accurate reporting of your business activities.

Related links form

Filing your own Schedule C involves completing the form with accurate details regarding your income and expenses. After filling it out, you will submit it alongside your Form 1040 when filing your taxes. Many people find it helpful to use a Schedule C Pdf Filler for assistance in completing the form correctly. This tool can guide you through the filing process, ensuring everything is accurate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.